Featured Articles

Back to Basics – Health and Welfare LPA

From: The Society of Will Writers We’ve previously looked at the consequences of not having a Property and Financial Affairs Lasting Power of Attorney (LPA) in place, however that’s only one of the two types of LPA available. In this article, we’ll take a look at the...

Understanding Inheritance Tax in the UK: Key Considerations

From: Kings Court Trust Inheritance Tax (IHT) is a significant concern for many families in the UK. With frozen thresholds and increasing property values, more estates are subject to this tax. This blog explores the essentials of IHT and offers insights into...

Back to Basics – Property and Financial Affairs LPA

From: Society of Will Writers We’ve previously looked at the consequences of not having a Health and Welfare Lasting Power of Attorney (LPA) in place, however that’s only one of the two types of LPA available. In this article, we’ll take a look at the Property and...

Bereaved Minor’s Trusts

From: The Will Company What are Bereaved Minor’s Trusts? A Bereaved Minor’s Trust is one of the most common trusts that will arise from a will. It is a trust that will arise if a gift is made to the testator’s own children with an age condition of eighteen. It will...

Grant on credit for Estate Administration

From: Kings Court Trust In certain circumstances, HMRC will allow a Personal Representative to postpone payment of all or part of the tax and interest due on delivery of an account. This is referred to as a Grant on credit. This year's Spring Budget (6th March 2024),...

How difficult is it to do probate yourself?

From: Kings Court Trust https://www.kctrust.co.uk/blog/how-difficult-is-it-to-do-probate-yourself Probate is the process of obtaining a Grant of Probate, which is the legal document that an Executor may have to obtain in order to administer the estate of someone who...

Protect your digital memories for future generations

There are three things you can do today to protect your digital memories 1. Update your legacy settings It takes just five minutes to log in to your digital accounts, update the legacy settings and protect your digital memories. CLICK TO MAKE THE CHANGES 2. Talk to...

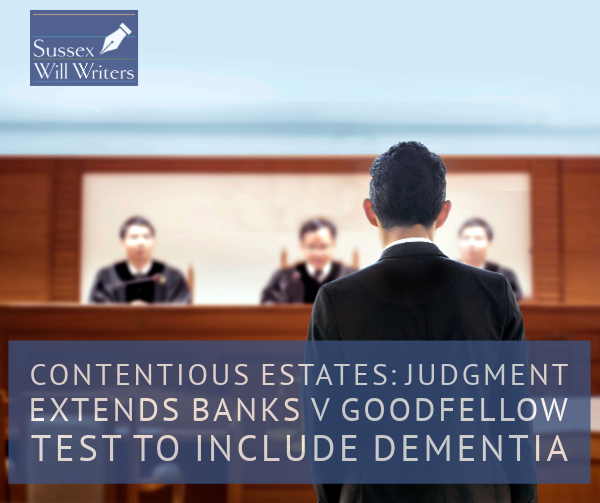

Contentious Estates: Judgment Extends Banks v Goodfellow Test to Include Dementia

From: The Will Company The England and Wales High Court's recent judgment in Leonard v Leonard (2024 EWHC 321 Ch) has broadened the scope of the fourth limb in the Banks v Goodfellow test for testamentary capacity to cover any disorder of the mind, such as dementia,...

Finding a Will When Someone Dies

from: Kings Court Trust A step that often causes family members additional stress and anxiety when someone dies is locating the deceased’s important documents. This includes the Will, which details the Testator’s wishes regarding how they want their estate to be...

Create a Digital Estate Plan

from: Kings Court Trust When estate planning, there are some things that are essential to include. For example: who will inherit any property, who may care for a dependent child, or what should happen to various personal belongings. One thing that often gets...

LPAs: Action Required on the Death of the Donor or an Attorney

From: The Will Company A Lasting Power of Attorney (LPA) ceases when the donor of the power dies. It may also cease if an attorney dies. Even if the LPA doesn’t end on the death of an attorney there may be a change to how the power works, for example a replacement...

‘Saltburn’: How the Catton Family could have Protected the Saltburn Estate, and could Oliver’s Inheritance still be Contested?

From: Today's Wills and Probate The dark comedy, psychological thriller that is Emerald Fennell’s ‘Saltburn’ has recently taken social media by storm, trending for its twisted storyline, leading to the demise of the aristocratic Catton family. *Trigger warning, and...

What happens to my debt when I die?

From: Kings Court Trust The period after the death of a loved one is a difficult time; and many people prefer to avoid thinking about it in advance. There are many challenges to consider; not only the emotional difficulties, but also the administrative duties that...

Your questions answered: Reporting and making changes to your LPA

From: The Office of the Public Guardian Your questions answered: Reporting and making changes to your LPA We receive thousands of phone calls each week from people looking for help and information on the lasting power of attorney (LPA) process. This blog series...

An overview of Inheritance Tax and gifting

From: Kings Court Trust When estate planning or dealing with the estate of someone who has died, you may have to handle Inheritance Tax (IHT). The different forms, rates, and requirements can be confusing, especially if you haven’t come across them before. This blog...

10 things to consider when writing your Will

Getting around to writing your Will can be difficult. Most people don’t like to think about what will happen when they die, and it’s one of those tasks that feels easy to delay. Many people die without leaving a Will, which can cause a lot of stress for their loved...

Funeral Costs Hit Record High

Cost of dying hits record high amid economic struggles, research finds. Recent findings from SunLife's annual report reveal a significant increase in the UK's cost of dying, now at an all-time high of £9,658. This figure includes funeral expenses, professional fees,...

Probate Service Delays

Probate service ‘now in recovery after management team replaced’, says UK government. The UK’s Parliamentary Under-Secretary of State for Justice has said that a new management team has been installed in the probate registry as part of a recovery plan to address...

Dealing with Animals & Pets in a Will

Where a person owns animals or pets, considerations should always be given to what should happen to those pets on their death. Although many people will consider dealing with their pets in their Will as similar to guardians for their children, pets are considered a...

Resolution calls for more rights for unmarried couples

From: Today's Wills and Probate New research from family justice body Resolution has found most people back a change in the law to give cohabiting people more rights. Currently couples have few or no rights in the event of a relationship breakdown meaning that unlike...

Who should be the Executor of a Will?

From: Kings Court Trust Executors are people chosen and named in a Will by the Testator, who is the individual whose Will it is. The Executors of a Will are responsible for administering the estate of the Testator when they have passed away. Up to four Executors can...

Who can Bring an Application Under the Inheritance Act 1975?

Who can Bring an Application Under the Inheritance (Provision for Family and Dependents) Act 1975? From: The Will Company Any person has testamentary freedom – the freedom to leave their estate how they see fit on their deaths. Despite this freedom, there are routes...

Lasting Power of Attorney Real Life Stories Kamlesh

From: The Office of the Public Guardianhttps://publicguardian.blog.gov.uk/2023/11/10/power-of-attorney-stories-kamlesh A lasting power of attorney (LPA) allows you to nominate someone you trust, known as an attorney, to step in if you lose the mental capacity to make...

Lasting Power of Attorney – Real Life Stories

From: The Office of the Public Guardian https://publicguardian.blog.gov.uk/2023/10/23/power-of-attorney-stories-shirin A Lasting Power of Attorney (also known as an LPA) if a legal document that allows you to nominate someone you trust to step in and make decisions...

HMRC Makes Further Adjustments to UK Trust Registration Services (TRS) Guidance

From: The Will Company The manual for the UK Trust Registration Service (TRS) has been amended several times over September 2023, as HMRC continues to iron out details of the complex rules for compulsory registration. Extra content on property held on behalf of minor...

Step forward to online lasting powers of attorney

From: The Office of the Public Guardian Step forward to online lasting powers of attorney The most vulnerable in society will be better protected as reforms to simplify and streamline lasting powers of attorney are given Royal Assent. From: Ministry of Justice,...

What is a Personal Representative?

From: Kings Court Trust The term Personal Representative might sound daunting, especially if you’re navigating the complex process of estate administration for the first time. A Personal Representative is responsible for the administration of a deceased person's...

General Power of Attorney

From: The Will Company A General Power of Attorney (GPA), also know as an Ordinary Power of Attorney, is a type of Power of Attorney that will allow a person to appoint attorneys to make decisions on their behalf. These are not as widely used as a Lasting Power of...

Understanding Co-Ownership, Joint Tenancy & Tenants in Common

From: The Will Company Co-ownership of land and property by two or more individuals has some distinct implications. Usually, it may be entirely clear who the owners of a property are, however there are cases where there may be confusion. It is therefore important to...

Common Questions in our Inbox – Discretionary Trusts

From: The Will Company A Discretionary Trust is a type of Trust where the trustees are given complete discretion to pay or apply the income or capital of the assets that are in the Trust, for the benefit of one or all of the beneficiaries. They have control over how...

Ostrich Egg Will

From: The Will Company Writing a Will on an Ostrich Egg? To be valid a Will must comply with all of the requirements set out below which is found in section 9 of the Wills Act 1837. No Will is valid unless:- It is in writing and signed by the testator, or by some...

Update on probate delays and how to avoid a stopped application

From: Kings Court Trust Bereaved families and estate administrators across England and Wales continue to face delays when applying for a Grant of Representation – the umbrella term for Grant of Probate (when there is a Will) and Letters of Administration (when there...

Vulnerable Beneficiary Trusts – What You Need to Know

From: The Will Company Trusts for Vulnerable People Some Trusts for disabled people or children get special tax treatment. These are called 'Trusts for vulnerable beneficiaries'. Who Qualifies as a Vulnerable Beneficiary A vulnerable beneficiary is either someone...

What Happens if a Will Is Lost?

From: The Society of Will Writers As we know, a Will takes effect on death, so it’s important to keep it safe for when it’s needed. Some may choose to store their Will with their will writer, a solicitor, at their bank or with a professional storage company such as...

What is a Deed of Appointment in probate?

From: Kings Court Trust What is probate?Probate refers to the process of obtaining a Grant of Probate, which is a legal document that provides the Executor of an estate with the legal right to proceed with estate administration. Estate administration refers to...

Record Inheritance Tax Receipts

From: The Will Company Inheritance Tax (IHT) receipts continued their record-breaking upwards trend into the new financial year, data released this week by HM Revenue & Customs (HMRC) has confirmed. According to figures for April 2023, receipts during the month...

The difference between a Lasting Power of Attorney (LPA) and a General Power of Attorney.

from: The Will Company It is common for us to be asked the difference between a Lasting Power of Attorney (LPA) and a General Power of Attorney. The table below is designed to give you some of the obvious stand out differences. In basic terms, the GPA is used as a...

Wills & LPAs – Who can See What?

from: The Will Company Can the terms of a donor’s Will be disclosed to their attorneys? When attorneys are acting under a Lasting Power of Attorney (LPA) for Property & Financial Affairs (P&A) or under an Enduring Power of Attorney (EPA), they may wish to...

How to Ensure Digital Identities Never Die

from: The Will Company Make a legacy account for Apple This one is a must. Clients can follow STEP’s easy guide below to make a legacy contact with Apple. It will take less than five minutes and it will mean that their legacy contact has access to all of their iCloud...

LPA delays beginning to ease, data reveals

from: Today's Wills and Probates New data on the timeliness of Lasting Powers of Attorney (LPA) applications* has revealed that the well-documented delays affecting the process are beginning to ease. Answering a parliamentary question from Labour MP Beth Winter...

What is an Advance Decision and should I consider one?

from: The Society of Will Writers You may not have heard of an Advance Decision before but they’re a very powerful document for anyone who has strong feelings about what medical treatment they would want to receive, and would want to make sure that their wishes were...

Hotchpot Clauses

from: The Society of Will Writers A testator may want to make gifts of money to one or more of their children during their lifetime for a number of reasons, for example to loan money to the child or even assist with a house purchase. The monies would either be given...

Vulnerable Clients and How to Protect Their Interests

From: The Society of Will Writers A couple finds themselves writing their Will(s) as they’re getting on in age and ability, their child a vulnerable individual. Their vulnerability isn’t what’s important here, only that they have care needs, and they are not sure how...

IHT receipts £700 million higher than this time last year

From: Today's Will's and Probate New data released by HM Revenue & Customs (HMRC) has revealed inheritance tax (IHT) receipts are some £700 million higher than this time last year. Total receipts from April 2022 to December 2022 now sit at £5.3 billion compared...

Why Use a Professional to Prepare Your Will

From: The Society of Will Writers You’ve decided now is the time to put documentation in place to protect your estate. What next? There are different options available to you when it comes to making a Will:- See a professional; orWrite a Will yourself Many have the...

Simplified process for verifying the death of a donor, attorney, deputy or guardian

From: Office of the Public Guardian We have simplified the process we follow after being notified that someone has died. We now verify deaths using the Post Office (HMPO) Life Event Verification system, so there is no longer a need for people to send in a death...

Care Fees

From: The Society of Will Writers We receive many queries daily on care fees assessment and how a home can be protected from care fees and whether it counts towards the means test carried out by the local authority, so we thought we would put together some...

Five reasons why you should use The National Will Register

From: The National Will Register The National Will Register recently announced it now has 10 million Wills in its system. A first for such a will register in the UK and only 16 years since its inception. In that time, we’ve heard a lot of questions asking why it’s...

The Benefits of Discretionary Trusts

From: The Society of Will Writers A discretionary trust is a type of trust where the trustees are given complete discretion to pay or apply the income or capital of the assets for the benefit of one or all of the beneficiaries. They have control over how much to...

Peace of Mind and Good Wills for Less

10% Off Wills and Lasting Power of Attorney in November & DecemberOffer Valid: 8th Nov 2022 - 31st Dec 2022 Quote Offer Code: DEC10 Writing a Will isn’t nearly as difficult or disturbing as many people fear. In fact, when asked, all of our clients say that they...

What happens if a beneficiary cannot be found?

From: Kings Court Trust When someone passes away, their loved ones and those dealing with their estate are left with a variety of tasks that must be completed before inheritance can be distributed. If the beneficiaries of the deceased’s estate cannot be found, this...

Mitigating IHT

From: The Will Company Inheritance tax (IHT) is payable on death or at certain stages during lifetime. For the purposes of this article we will look at the IHT charge payable on death which relates to the deceased’s estate. On death, the executors will calculate the...

Trusting Millennials

From: The Will Company It has been revealed that 1-in-4 Baby Boomers don’t trust the younger generation to use their inheritance wisely, according to a national survey by professional services firm, Progeny. Additionally, nearly half (48%) of Baby Boomers say the...

Back to Basics – Property Protection Trust

From: The Society of Will Writers Property Protection Trusts (PPTs) are by far one of the most common types of trusts included in wills. The PPT is designed to take the deceased’s share in the home and give someone else (known as the life tenant) a life interest in...

10% Off All Wills and Lasting Power of Attorney in Oct

10% Off Wills and Lasting Power of Attorney in OctoberOffer Valid: 7th Oct - 7th Nov 2022 Quote Offer Code: SPOOKY10 Writing a Will isn’t nearly as frightening as many people fear. In fact, when asked, all of our clients say that they feel more relaxed and less...

What happens to Premium Bonds when someone dies?

From: Kings Court Trust When someone passes away, all of their assets must be dealt with as part of the estate administration process. This can include property, personal belongings, cash, bank accounts, and more. One asset that is not as commonly discussed is...

Leaving Park Homes, Houseboats & other Forms of Mobile Residence in Your Will

From: The Will Company A mobile home is a tricky area under succession law and this article is only designed to take quick glance into dispensing of a mobile home by the Will; being that they are markedly distinct from what we may deem as more traditional property of...

Soaring Residential Property Values Continue to Boost Inheritance Tax Receipts

From: The Will Company The latest data from HM Revenue & Customs (HMRC) has revealed that inheritance tax (IHT) receipts remained sky-high in August. The take of roughly half a billion pounds in the period July – August alone brings the overall IHT receipts for...

What will Happen to the Queen’s Estate?

from: The Will Company Following Queen Elizabeth II’s death, much attention has been placed on what will happen to her estate and who will be the beneficiaries of it. The estate, which is estimated to be valued at £15.2 billion in assets – which technically...

Can probate fees be paid from the estate?

From: Kings Court Trust When dealing with the death of a loved one, many Executors find themselves worrying about the costs of administering the estate and how fees can be paid. Acting as an Executor or Administrator is not a paid role, and it’s common to feel...