from The Will Company

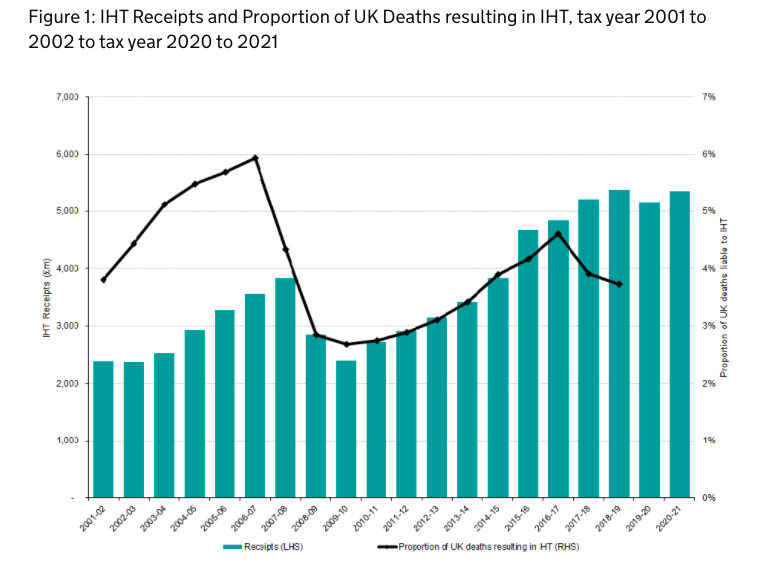

The link at the end of this of this post is a wonderful commentary on the income from IHT to HMRC. Very worthwhile reading.

The keys points from this year’s publication are:

- In the tax year 2018 to 2019, 3.7% of UK deaths resulted in an Inheritance Tax (IHT) charge, decreasing by 0.2 percentage points since the tax year 2017 to 2018. This continues the fall seen last year and is again likely due to the phased introduction of the Residence Nil-Rate Band (RNRB) tax-free threshold from April 2017.

- The total number of UK deaths that resulted in an IHT charge has also fallen. In the tax year 2018 to 2019, there were 22,100 such deaths, a decrease of 2,100 (9%) since the tax year 2017 to 2018. Again, this is likely due to the continued phased introduced RNRB.

- IHT receipts received by HMRC during the tax year 2020 to 2021 were £5.4 billion, an increase of 4% (£190 million) on the tax year to 2019 to 2020. This reverses the fall seen last year and means receipts have been broadly flat across the four years since the tax year 2017 to 2018. Receipts are below the peak seen in the tax year 2018 to 2019 by £33 million.

- The combined value of agricultural and business property relief (APR, BPR) was £3.49 billion in the tax year 2018 to 2019. This was a fall of £44 million (1.2%) compared to the tax year 2017 to 2018. While the value of BPR rose by £310 million, the value of APR fell by £354 million to more than offset itself. While the combined value is still below the peak of £3.8 billion seen in the tax year 2014 to 2015, the value of BPR claimed on unquoted shares is now equal to the tax year 2014 to 2015 peak, at £1.7 billion in the tax year 2018 to 2019.

- The value of exempted transfers to qualifying charities also fell, from £2.8 billion in the tax year 2017 to 2018 to £1.7 billion in the tax year 2018 to 2019.

Could you do with some FREE, sound advice on:

- Writing a Will – What do I need and how much does it cost?

- Creating Lasting Powers of Attorney – If I was incapacitated who can act on my behalf?

- Property Protection Trusts – Can these really save Care Home Fees?

- Pre-Paid Funeral Plans – With so many to choose from how do I decide which plan is best?

There is so much confusion on these vital areas of estate planning, that sometimes just a chat with an expert in the field can clear up misunderstanding and set out the way ahead, without all the legal jargon.

Or complete the form below

Steve Worsfold

Affiliate Member of the Society of Will Writers

Advising on Wills/Trusts/Probate/Powers of Attorney

Mobile: 07734 744886

Office: 01903 533681

Email: steve@sussexwillwriters.co.uk

Website: www.sussexwillwriters.co.uk

Protecting What’s Precious to You,

Now and in the Future

Sussex Will Writers is proud to support Dementia Friends,

an initiative of The Alzheimers Society

Our business is certified ‘Safe to do business with’ and ‘Code compliant’

by the UK’s largest regulatory body for Will Writers, The Society of Will Writers.

Steve Worsfold has been an Affiliate Member of the Society for 15 years.

Sign Up to Receive our Free Newsletter

We send a Newsletter once a quarter and only occasional mailings to provide updates on changes in government policy or news of any special offers. You can download the latest version of our Newsletter by signing up with your name and email.

Sign Up to Receive our Free Newsletter

We send a Newsletter once a quarter and only occasional mailings to provide updates on changes in government policy or news of any special offers. You can download the latest version of our Newsletter by signing up with your name and email.